A Sense of Doubt blog post #2307 - "Some say the world will end in fire, Some say in ice" - Weekly Hodge Podge of 2106.12

It hurt me deeply to see that Salt Lake’s @yumyumasian food truck was recently vandalized – I know the pain that hateful language and racism causes. With help from @identitygraphix we’ll be able to restore the truck and hopefully lift Ben and his family’s spirit!! #StopAsianHate pic.twitter.com/HLfzX7AaEc

— Jordan Clarkson (@JordanClarksons) June 9, 2021

Javier Báez.

— Chicago Cubs (@Cubs) May 27, 2021

El Mago.

The Magician. pic.twitter.com/yZX7HgUFCU

Javy Baez fools Pirates into the dumbest baseball play of the season

https://sports.yahoo.com/javy-baez-fools-pirates-into-the-dumbest-baseball-play-of-the-season-174849767.html

It's cliché to say Chicago Cubs shortstop Javier Baez is magic. His nickname is literally "El Mago" — the magician. But after seeing what Baez pulled off against the Pittsburgh Pirates on Thursday, you're going to wonder if Baez is actually a wizard.

It's pointless to try and explain the wacky play first, so take a look at what happened and try to comprehend how Baez got away with it.

With a runner on second, Baez hits a ball to Pirates third baseman Erik Gonzalez. The ball is fielded cleanly by Gonzalez, who throws it to first baseman Will Craig. Gonzalez's throw takes Craig off the bag, so Craig decides he'll just tag Baez instead.

Recognizing this, Baez starts running back toward home plate. He remains in the base path, so he hasn't broken any rules. As Baez gets close to the plate, the runner who started on second sprints toward home to try and score. Craig throws the ball to the catcher, but is too late. The run scores, giving the Cubs a 2-0 lead.

Baez, who was never tagged, begins to quickly sprint toward first base. In the confusion, no Pirates player is covering first. A member of the Pirates sprints over the first, but the throw from Pirates catcher Michael Perez is just slightly off target. Baez slides into first, but then quickly gets up and makes it all the way to second base.

The Cubs dugout — primarily Anthony Rizzo — erupted in cheers and laughter following the play.

OK, Pirates fans, we know that was painful enough to watch. Unfortunately, we now have to reveal the absolute worst part of the play: There were two outs.

Craig could have stepped on first base and easily retired Baez, ending the inning. Instead, he either forgot the number or outs, or was so enticed by chasing Baez down that baseball logic deserted Craig in that moment. The rest of the Pirates bear some responsibility here too. Did any of Craig's teammates yell at him to just tag the base? They all seemed to go along with it.

The Cubs would eventually win the game 5-3.

Javier Baez explains what went through his mind during play

Baez told reporters after the game that he was actually planning to dive headfirst into first base, but the throw reached first base so early that he tried to extend the play. It was only after making a safe call at the plate that it occurred to him the run wouldn't count unless he made it to first.

Meanwhile, Pirates manager Derek Shelton immediately took responsibility for his players' gaffe(s), though you'd think an MLB manager should be able to expect his players to know that an out of first would end the inning no matter the play at home.

Pirates starting pitcher Tyler Anderson also conceded that every other player on the field should have been yelling for Craig to step on first. Alas.

The Cubs' win improved their record to 27-22. The team has played much better after a slow start, winning three straight games coming into Thursday's matchup.

The Pirates, as you may have guessed, are performing much worse this season.

Bill Murray has a creative solution to keep the Cubs core together 😂🍋 pic.twitter.com/5JV6wjDyRo

— Cubs Talk (@NBCSCubs) June 11, 2021

“To me it seems risky on the whole, to bring too many of these dark

~Carl Jung, “Jung” by Gerhard Wehr, p. 269

Here's what dogs are saying when they lean on you - plus the meaning behind 49 other things that they do.

— Shareably (@Shareably) January 15, 2019

https://www.poetryfoundation.org/poems/44263/fire-and-ice

Fire and Ice

BAD STUFF

Here's your stories!

10. Ohio Kooks Think COVID-19 Vaccine Will Give You Freaky Magnetic Powers Like That's A Bad Thing. These people are HILARIOUS.

9. Jerry Falwell Jr. HEREBY DEMANDS That Liberty University QUIT KINK-SHAMING HIM! This fucking guy.

8. What Time Is It? It's (Red) Wine (Paloma) O'Clock! Well hello Matthew Hooper! Come right on in!

7. Joe Manchin Can Name 12 Logical Fallacies Preventing Him From Supporting Voting Rights. This fucking guy.

6. And Now, Your Obligatory Post About Jeff Bezos's DONGROCKET. This was a good post.

5. 70 Percent Of Americans Gay For Gay Marriage, Happy F*ckin' Pride! YAY!

4. If You Like Pina Coladas, Here, Have One! And again!

3. Did Devil Give Rick Wiles COVID For Letting Milo Talk About Giving Up Dong On His Show? Sure Why Not. This was a weird one.

2. Milo Yiannopoulos Claims Going Ex-Gay Made Dogs Stop Barking At Him. It just sounds right.

1. Time For Fun New Game, 'Did Your Wonkette Donation Expire'! Well DID IT PUNK? Go ahead and check again. We love you.

And there you have it: This week's top 10 as chosen. BY GOD.

https://slate.com/news-and-politics/2021/06/trump-justice-department-subpoena-apple-democrats-schiff-swalwell.html

Trump Justice Department Secretly Subpoenaed Records on Top Democrats, Their Families and Staff

After a series of damaging leaks about contacts with Russian officials in the early moments of the Trump era, the Department of Justice took the extraordinary step of subpoenaing data from Apple on top Democrats, their families, and their staff, in an effort to identify the source of the leaked information. The New York Times reports that at least a dozen people associated with the House Intelligence Committee had their records seized, including then–ranking member of the committee Adam Schiff and committee member Eric Swalwell. The surveillance reportedly encompassed the subjects’ metadata, whom they were communicating with, not the content of those communications. One of the individuals whose records was subpoenaed was a minor, presumably a family member of one of the targets, because the DOJ suspected officials might be using their children’s computer to leak to avoid detection. The surveillance was not made known to the targets until last month due to a gag order on Apple that recently expired.

Other administrations, including the Obama administration, have aggressively hunted leakers, but the latest revelations show how far and beyond the Trump administration was willing to go, essentially from the start of the Trump presidency. The records seized were reportedly from 2017 and early 2018, as Attorney General Jeff Sessions bore the brunt of Trump’s rage about all things Russia. Leaked contacts between Michael Flynn and then–Russian Ambassador to the U.S. Sergey Kislyak led to Flynn’s ouster and ultimately federal charges. The leaked information was explosive: It showed the continuation of curious contact between Trump World and Russia; it also revealed that the FBI had used a court-authorized secret wiretap on Kislyak that ensnared the future national security adviser.

“Ultimately, the data and other evidence did not tie the committee to the leaks, and investigators debated whether they had hit a dead end and some even discussed closing the inquiry,” the Times notes. “But William P. Barr revived languishing leak investigations after he became attorney general a year later. … Barr directed prosecutors to continue investigating, contending that the Justice Department’s National Security Division had allowed the cases to languish, according to three people briefed on the cases.” The moves smacked of political targeting to some in the Justice Department.

The secret targeting of sitting members of Congress from the opposite party, particularly those leading an investigation related to the White House, is an extraordinary step that requires truly extraordinary evidence. The fact that so far reports indicate no evidence was found linking the targets to the actual leaks indicates the administration had an ulterior motive: snooping on its political enemies. These disturbing revelations come on the heels of news that the Trump DOJ carried out similar, secret surveillance of journalists covering the White House for a host of major news organizations, raising serious questions about the appropriateness of the Trump administration’s use of its surveillance powers in what appears to be a broad and dangerous overreach.

https://www.motherjones.com/crime-justice/2021/06/trump-went-on-an-execution-spree-biden-can-make-sure-that-doesnt-happen-again/

Trump Went on an Execution Spree. Biden Can Make Sure That Doesn’t Happen Again.

He “could do that tomorrow with the stroke of the pen.”

NATHALIE BAPTISTE

The white supremacist who murdered nine Black churchgoers in Charleston, South Carolina, in 2015 is in the news again. Dylann Roof, who was sentenced to death by the federal government in 2017, has filed an appeal. His lawyers have argued that the judge in his trial should not have permitted Roof to represent himself because he is mentally incompetent, and therefore his sentence should be overturned. His appeals were to be expected—but they highlight urgent questions about the federal death penalty and President Joe Biden’s pledge to end the practice.

Biden has made history as the first president to expressly oppose the death penalty during his campaign, which was a radical reversal from his position during his 36-year tenure as the senator from Delaware and as Barack Obama’s vice president. In its criminal justice platform, the Biden campaign pledged to abolish the death penalty at the federal level and incentivize states to follow suit. In the past, candidates avoided taking this stance on capital punishment out of fear of appearing weak on crime and soft on criminals. His death penalty stance during the waning days of the Trump administration marked yet another difference between him and the incumbent president who had always been a fierce proponent of capital punishment.

President Donald Trump was a historic figure in criminal justice for many reasons, but especially for the fact that he was responsible for the first federal executions in 17 years. In the final six months of his only term in office, he put 13 federal inmates to death, including three after he’d lost the 2020 election. Because it was so unprecedented, the execution spree garnered a lot of media attention for an issue that hasn’t always been a top concern for the wider public. Biden’s campaign promise to end capital punishment was only one item in a long list of Trump-created messes that the new president promised to fix.

But nearly five months into the new administration, there’s been little follow-through on the commitment. Granted, the current administration has no plans to schedule executions for the 46 men on the US government’s death row. As Abraham Bonowitz, the executive director of Death Penalty Action, a nonprofit dedicated to abolishing the death penalty, notes, “The people on death row are safe—for the moment.” But there’s a real risk in not going further than simply not scheduling executions.

The tasks ahead for Biden—addressing climate change, rampant economic inequality, crumbling infrastructure, and the ongoing pandemic—are all monumental. And perhaps the federal death penalty just doesn’t feel as urgent because the president has already promised that his administration would not be executing any inmates. But all it will take to resume federal executions is one determined GOP president.

While the states have executed more than 1,500 people since the US Supreme Court reinstated the practice in 1976, the federal government had only put three to death since 1988—until last year. In 2014, former President Barack Obama ordered a policy review on federal death penalty, while the US government investigated lethal injection protocols. The move came after a highly publicized botched execution in Oklahoma, but, as Trump vividly demonstrated, an unofficial moratorium is hardly enough to stop a determined president. Obama’s failure to make a meaningful impact on capital punishment at the federal level left the door open for an execution-loving president to fire up the death machine.

If the states with the death penalty foreshadow what a future GOP president might do on the execution front, it’s not a good sign for abolitionists. Death sentences and actually following through on them may have been on the decline for more than a decade, and the United States remains one of the few countries that still uses this as a punishment. But now that lethal injection drugs are not readily available—manufacturers are refusing to allow states to use their products for these actions—states still carrying out the punishments are going to great lengths to insure state-sanctioned killings continue. After a 10-year hiatus in South Carolina, due to the difficulty in acquiring the drugs, lawmakers recently passed a law that would make the firing squad an alternative method. Arizona is refurbishing its gas chamber, and so is Alabama. Following Trump’s example yet again, many Republican-led states want to reenergize their execution chambers. Should a Republican succeed Biden, it seems inevitable that this will take place on the federal level as well.So, what are Biden’s options? One is legislation. In July 2019, when the Trump administration announced its intention to execute death row inmates, Rep. Ayanna Pressley (D-Mass.) and Sen. Dick Durbin (D-Illinois) introduced a bill that would abolish the practice and resentence every person on death row. Nearly two years later, the bill has support from 90 members of Congress and 18 co-sponsors. This is what advocates like Bonowitz are focused on right now. “It’s on us as abolitionists to build a coalition to get him a bill to sign,” he explains. But time is of the essence. It’s clear that the only way legislation like this would pass both chambers is with the Democrats in the majority. If the Republicans win back the House next year, the chances of abolishing the federal death penalty become infinitesimal.

There is another option that would make it much harder for any future president to carry out executions. The president has the power to commute all of the sentences of the people on death row himself, without congressional approval. “Joe Biden could do that tomorrow,” Bonowitz says “with the stroke of the pen.”

Of course, at a time when violent crime is rising across the country and conservatives are falsely blaming it on anti–police brutality activists and movements to defund police departments, it’s easy to see why Biden would hedge on removing dozens of people from death row. I can already hear the bad-faith attacks describing Biden and the Democrats as being supporters of Roof and his racist crimes. Yet this president has also tried to make racial justice the cornerstone of his administration, and, like seemingly everything else in our criminal legal system, capital punishment is arbitrary and racist. Studies have shown that Black people are more likely to be sentenced to death and of the 46 people currently on federal death row, nearly 40 percent of them are Black.

The Trump presidency featured a lot of firsts and historic moments—usually horrific ones—and his excesses with the death penalty were no exception. The overarching message of Biden’s campaign was that he would fix what Trump had broken. But it’s not enough to simply put a Band-Aid on whatever horrors Trump created or exploited—our whole democracy must be shielded against the next such leader. And that’s why there is inherent danger in cautious incrementalism on the death penalty. If the Biden administration leaves the system in place, the next Trump will almost certainly come along and abuse it once again.

It’s Not Just Income Taxes. Billionaires Don’t Pay Inheritance Taxes Either.

As a Trump adviser once said, only “morons” would do that.

If you are an American citizen with hundreds of millions of dollars in assets, this would be a great time to die. No disrespect intended. It’s just a fact. For seldom have there existed better conditions for transferring vast fortunes to one’s offspring.

A married couple can now leave a total of $23.4 million to the kids without paying a dime in federal estate or capital gains taxes. That’s the highest exemption level in decades, not counting a temporary repeal of the estate tax in 2010. And the opportunities to sidestep inheritance taxes are legion. So much so that when Goldman Sachs alum Gary Cohn, then an adviser to President Donald Trump, kicked a hornet’s nest by reportedly joking that “only morons pay the estate tax,” wealth professionals around the country were no doubt nodding in agreement. (One Cohn defender explained that whatever he may have said, Cohn was merely alluding to rich folks who don’t take advantage of rigorous tax planning.)

America’s ultrawealthy already get away with murder by structuring their finances to avoid income, and therefore income taxes. It’s not rocket science. CEOs typically take the lion’s share of their earnings in stock and other nonwage compensation, for example. And while employees do have to pay income and payroll taxes on the initial value of stock granted in lieu of wages, anyone who accumulates a large trove of assets can hold onto those growing investments and use them as collateral for low-interest loans to fund their lavish lifestyles. Voila! No income. This is a lot cheaper than selling off chunks of stock and paying tax on the gains.

The top income tax rate these days is 37 percent, but as ProPublica revealed in a bombshell report this week, megawealthy fellows like Jeff Bezos, Michael Bloomberg, Warren Buffet, Carl Icahn, and Elon Musk pay a few percent at most. The situation is equally bad—or good, depending on your perch—with gift and inheritance taxes, which max out at 40 percent. Those taxes, if properly imposed and collected, would help narrow our yawning wealth gap and perhaps limit the toxic influence of dynasties in the political process. But, as Cohn intimated, they are easy to beat.

In a comprehensive 2020 analysis, Lily Batchelder, a tax policy expert at the New York University School of Law who is awaiting Senate confirmation as assistant treasury secretary, writes that the effective tax rate on inheritances is a piddling 2.1 percent, “less than one-seventh the average tax rate on income from work and savings.” She points out, too, that Americans were projected to inherit some $765 billion in gifts and bequests last year, and that a large share of all US wealth—about 40 percent—is derived from inheritances. “Despite our national mythos as a land of opportunity,” Batchelder writes, “the United States also has one of the lowest levels of intergenerational economic mobility. That is, relative to other countries, financial success in the United States depends heavily on the circumstances of one’s birth.”

It may seem odd, given the success of the superwealthy in legally avoiding inheritance taxes, that America’s dynasties seem so desperate to dispense with them. In 2015, Public Citizen identified nine billionaire families lobbying actively for estate tax repeal. From 2012 through early 2015, the nonprofit reported, the Mars (candy) and Wegman (grocery) dynasties, together worth more than $137 billion combined, had spent more than $3.5 million on repeal. Other dynasties (Bass, Cox, DeVos and Van Andel, Hall, Schwab, and Taylor) spent a total of $7 million lobbying on this and other issues. The US Chamber of Commerce, according to public disclosures, also lobbies regularly for repeal of the “death tax.”

Since 2011, House Republicans have introduced at least 44 bills to kill the estate tax and the generation-skipping transfer tax, enacted to prevent wealthy families from bypassing a round or two of estate tax by passing large fortunes directly to grandchildren and great-grandchildren. The lobbying efforts noted above, though unsuccessful in their primary goal, appear to have paid off handsomely. As part of the roughly $2 trillion tax-cut package President Trump signed into law in December 2017, Republican lawmakers unilaterally—albeit temporarily—doubled the limit on how much money elite families could pass to their heirs in life and death without paying a tax.That lifetime exemption, as of 2021, is $11.7 million for an individual and $23.4 million for a married couple. So if my wife and I had $30 million—we do not—we could leave the majority to our kids tax free. Thanks to the “step-up in basis” (or “stepped-up basis”) rule, the values of our invested assets—stocks, artwork, real estate—would reset to their current fair market value when we die. Our heirs could then sell all those inherited assets and not pay a cent on the unrealized profits we accrued during our lifetimes—profits that would ordinarily be subject to a 20 percent capital gains tax.

Levies on the post-mortem transfer of property originated in Egypt around 700 BC, according to an IRS history. They were later imposed, around the time of Christ, by the Roman emperor Caesar Augustus, and then by feudal lords in Europe. America’s first death tax—that’s what it was officially called—was imposed as part of the Stamp Act of 1797 to cover the cost of US military skirmishes with France. The federal government charged 25 cents on postmortem bequests of $50 to $100, 50 cents on $100 to $500, and $1 on each additional $500.

Congress enacted a second round of death taxes in the Revenue Act of 1862 to raise funds for the Union to fight the Civil War. Lawmakers did so again in 1898 to bankroll the Spanish-American War. These taxes were not burdensome. In the latter case, if a wealthy man left behind $10 million—a staggering fortune—to a sibling, child, or grandchild, his estate owed the government just over 2 percent, about $219,000. All three taxes were repealed after the hostilities ceased.

By the late 1800s, however, America was transitioning rapidly from an agrarian economy to an industrial one. The old federal patchwork of tariffs and property taxes was leaving the fortunes of Gilded Age industrialists like Andrew Carnegie and John D. Rockefeller largely untouched. Reformers began calling upon the government to tax these “robber barons,” while the businessmen, as today, countered that such a move would stifle growth and quash innovation. The Revenue Act of 1916, in anticipation of the coming war effort, levied a tax of up to 10 percent on inheritances of $50,000 or more (about $1.1 million today); the levy was increased to 25 percent the following year, although it was later repealed. But Rockefeller never paid a penny. He just signed his fortune over to his son before he died, because Congress hadn’t yet passed a gift tax.

It wasn’t until 1976, after another six decades of tweaks, that Congress finally put in place a comprehensive, integrated gift-and-estate tax similar to what we have today. (The congressional Joint Committee on Taxation offers a detailed history.) America’s dynasties have been trying to get rid of it ever since. But the endless squabbling over the estate tax, which was expected to bring in just $16 billion last year, Batchelder writes, is largely a distraction from what’s really going on.While researching my new book about wealth in America, I interviewed a woman—we’ll call her Jane—who had been hired to work in the family office of a retired Wall Street banker. Family offices are private companies created by extraordinarily wealthy families to manage their myriad investments, businesses, and personal affairs. The family’s primary focus, typical among dynasties, was to grow and protect its wealth with the goal of passing along as much of it as possible to the children and grandchildren. Jane recalls the patriarch one day saying something like, “‘If the government keeps taking our money, we’ll take our money elsewhere’—meaning offshore. I don’t know if he was super serious, but he was super pissed about the Affordable Care Act,” which placed a 3.8 percent surcharge on America’s highest earners. “In terms of tax avoidance,” Jane says, “they were all about the GRATs, and used to do GRITs.”

That’s not breakfast. GRITs are grantor retained income trusts, once a popular estate-tax dodge. GRITS were replaced by grantor retained annuity trusts, or GRATS. These are just two ingredients in an alphabet soup of legal instruments—GRUTs, CRATs, CRUTs, CLATs, CLUTs, QTIPs, QPRTs, SLATs, etc.—that estate lawyers for hyper-affluent families deploy to maximize intergenerational wealth transfer. GRATs are particularly handy when interest rates are low—namely, the federal 7520 interest rate, which averaged an unheard-of 0.61 percent during the first 12 months of the pandemic.

Here’s how they work—specifically “Walton GRATs,” the kind everyone uses. You have your lawyer set up the trust and assign a bunch of assets to it—that could be stocks, a Picasso painting, a stud racehorse, whatever. The initial value of the assets, plus interest calculated at the outset using that month’s 7520 interest rate, gets disbursed back to the trust’s creator in annual installments (annuities) over the lifetime of the trust, which can range from two years to much longer—that’s up to you. If the assets in your Walton GRAT increase in value faster than the 7520 rate would have predicted, there will be assets left over at the end of the trust’s lifetime. Those assets go to your beneficiaries—your princelings—tax free. Better yet, they don’t count against that lifetime gift/estate tax exemption.

To play this game effectively, you need an asset that’s not worth very much now, but is likely to explode in value—like an initial stake in a private equity partnership or shares of a pre-IPO stock. In 2008, Facebook co-founders Mark Zuckerberg and Dustin Moskovitz set up annuity trusts, presumably for the benefit of generations not yet born. Before Facebook went public at $38 a share, its SEC prospectus reveals (see the chart and footnotes on p. 127), Zuckerberg transferred more than 3.4 million shares (some purchased for as little as 6 cents apiece) into the Mark Zuckerberg 2008 Annuity Trust. Moskovitz did the same with 14.4 million shares, and Sheryl Sandberg, Facebook’s chief operating officer, socked away 1.9 million shares in her annuity trust.

The federal interest rate was higher then—averaging about 3.8 percent in 2008—but the value of Facebook’s stock took off sometime after its IPO in 2012. Had those executives created GRATs with 10-year terms (that detail is not publicly available), their heirs stood to receive hundreds of millions of dollars—perhaps billions—without paying a dime in federal taxes. According to a 2013 report by Bloomberg’s Zachary Mider, the late billionaire and Republican megadonor Sheldon Adelson used a series of short-term Walton GRATs to transfer nearly $8 billion to his heirs, thereby avoiding billions of dollars in gift taxes. Pair that strategy with highly volatile stocks, as Adelson reportedly did, and you won’t always win, but you literally cannot lose.

So how did this ridiculously lucrative strategy come to pass? Well, the federal government created it—by accident. I called up Richard Covey, the octogenarian tax attorney credited as the inventor of the “no-risk” (his words) Walton GRAT. Covey edits a newsletter called Practical Drafting for Bank of America’s wealth management division, US Trust. Most Americans would never read such a publication, but estate lawyers sure do.

Back in the 1980s, when interest rates were relatively high, wealthy families embraced another of Covey’s innovations, the aforementioned GRIT, as an estate-tax workaround. The GRIT was a fairly modest dodge that might save a rich family a few percentage points on gift taxes. But Congress decided to curb what the IRS had deemed an abusive tactic. So the lawmakers tweaked the rules in 1988 and 1990, and unwittingly created a monster. “They completely blew it,” Covey told me. “Instead of tightening up on the law, they loosened up on the law, and they didn’t know that!”

The new rules let families use a setup similar to another ultrawealthy tax boondoggle known as “charitable lead trusts”—the aforementioned CLATs and CLUTs. These trusts were nicknamed “Jackie O trusts,” because the former first lady famously used them to enrich her children while giving to charity at the same time. As Bloomberg’s Mider also reported, the Waltons—America’s wealthiest family, with combined assets of more than $234 billion—made ample use of Jackie O trusts to transfer huge sums to their offspring without paying any taxes. On the contrary, they were able to take charitable deductions.

Walton GRATs were deemed legit in 2000, when Covey successfully defended Audrey Walton, the sister-in-law of Walmart founder Sam Walton, against a challenge by the IRS. (He’d used the same strategy with other clients, he told me, but Walton was the one who got called out by the tax commissioner.) Since then, Walton GRATs have saved America’s dynasties untold billions.

If all of this was based on a mistake, I asked him, why hasn’t Congress fixed it? Well, Covey replied, to do that, you’d realistically need a Democratic trifecta: House, Senate, and Oval Office. And that had happened only twice since 1990—during the first two years of the Clinton and Obama administrations. (Our conversations took place prior to the 2020 election.) Once it became clear that Democrats would again have the trifecta, wealth advisers and white-shoe law firms began alerting wealthy clients that, should they feel inclined to set up trust vehicles that would lock in the current, generous rules of inheritance, this would be a fine time to do so.

But the superwealthy needn’t fret. With a razor-thin margin in the Senate, it’s not at all clear the Democrats will be able to rein in tax policies that favor the megawealthy. Republican leaders have signaled, in no uncertain terms, that they won’t be on board with any rollbacks of the 2017 tax cuts. They oppose President Biden’s proposal to increase tax rates on long-term capital gains to match the rates workers pay on wages. And after years of gutting the ability of the IRS to pursue wealthy tax cheats, the Republicans intend to fight Biden’s plan to restore and enhance the tax agency’s enforcement budget.

So far, Biden has not targeted the estate-tax exemption, which is scheduled to reset to its pre-Trump level (half of the current level) in 2026, unless Congress extends it. He does, however, want to eliminate the stepped-up basis rule, a move that would compel heirs to pay capital gains taxes on their inherited assets past a certain threshold. But Batchelder, who, if confirmed by the full Senate, will be Biden’s top adviser on tax policy, aspires to fundamentally transform the way the government taxes inheritances.

She would repeal the gift and inheritance taxes, just as the Republicans have always wanted. Instead, she writes, “a wealthy heir would simply pay income and payroll taxes on their large inheritances, just as a police officer or teacher does on their wages.” Beyond a reasonable lifetime exemption, heirs would have to report inheritances as ordinary income, and would be expected to pay the same taxes the rest of us see on our pay stubs—including Social Security tax, which currently favors high earners because it maxes out once a person’s income hits $142,800.

Batchelder’s vision goes deeper, changing certain rules around complex trusts and family partnerships. With GRATs, for example, “the value of the heirs’ taxable inheritance would not be based on a rough projection of future events” calculated according to that 7520 interest rate, but rather on the real-life performance of the trust assets. In the meantime, the feds would charge a “withholding tax” on the trust at the maximum rate of about 50 percent. The Urban Brookings Tax Policy Center, she writes, calculates that the proposed reforms would raise an additional $340 billion over a decade if the lifetime exemption on inheritances is set at $2.5 million, and $917 billion if the exemption is $1 million.

Proposals so bold, an arrow in the heart of America’s aristocracy, are unlikely to be well received by America’s elite, or its wealth managers, who are compensated with a percentage of the assets they keep under management. The success of any big overhaul of the wealth-transfer system will almost certainly hinge on the results of the 2022 midterms, and even then, a stronger Democratic trifecta might not do the trick. More than half of the top 100 donors to federal candidates, parties, and PACs in the last election cycle, after all, gave primarily to Democrats. And chances are, they will have some strong opinions about all of this.

Portions of this article were adapted from Michael Mechanic’s recent book, Jackpot: How the Super-Rich Really Live—and How Their Wealth Harms Us All.

This story was updated to clarify that employees must pay taxes on stock granted in lieu of wages.

Republicans Filibustered the January 6th Commission Because They Can

The ends aren’t just anti-democratic, the means are too.

In the past, when elected officials in Washington wanted to avoid tackling an issue, a favorite tradition was to create a bipartisan commission to study it. You would convene some ex-senators—ideally veterans of previous bipartisan commissions, who no doubt had voted to create other such bipartisan commissions many times in the past—and they would spend several months or perhaps even years producing an impressively detailed report. This would generate some headlines and press releases, and then life would continue as it was. Often (though not always) they offered the illusion of work without the attendant consequences of doing any work. It was, and is, where “touchy issues,” as the Associated Press said, “go to die.” In that way, this system was desirable for two factions who are historically very well represented in the Capitol: People who do not want to do anything, and the people who want to say they’ve done something.

That was the old way of doing things. The new way is much simpler: Now you don’t need to announce a bipartisan commission if you want to kill momentum for reform—you can just kill the bipartisan commission instead.

On Friday, Senate Republicans filibustered a proposal to create a panel to investigate the insurrection of January 6th, in which a pro-Trump mob attacked the Capitol and shut down the certification of the Electoral college, leaving five people dead and ending a 200-plus-year tradition of peaceful transfers of power. The bill to create the commission had already passed the House with 35 Republicans votes. It had already been revised substantially to accommodate the things Republicans had said they’d want, such as the ability to appoint their own members. It was already a substitute for more concrete actions. After January 6th, Kevin McCarthy and other Republicans, suggested that Congress put together a team to do “fact-finding” into the attack, rather than impeaching the man most evidently responsible.

But even something as historically toothless as a bipartisan commission still represented a threat to most of the Republican conference. It was vocally opposed by ex-President Donald Trump, who holds great sway, to put it lightly over the caucus. In an unusually candid moment, Sen. John Thune of South Dakota told CNN that he opposed investigating January 6th because it would hamper the party’s midterm messaging—the last thing Republicans wants is to remind voters what happened that day and why. And so Senate Minority Leader Mitch McConnell, like McCarthy before him, encouraged his members to vote against it. Seven Republicans, most of whom previously voted to remove Trump from office in February, did support moving forward with the bill; eleven Republicans (and two Democrats) didn’t even vote.

But there’s another way in which this vote captures the drift of the Senate in recent years. Technically, this was not a vote on whether to create a bipartisan January 6th commission at all—it was a vote on whether to debate a bill to create a bipartisan January 6th commission. The Senate, on paper, still does run on majority rule. The commission would only need 50 votes (plus Vice President Kamala Harris) for final passage. Friday’s roll-call suggests it would have cleared that threshold comfortably and in a bipartisan manner. But under the current Senate rules—which Democrats could simply change, if they wanted to!—the procedural motion to move forward with debate requires 60. So this kind of legislation doesn’t even officially get blocked anymore; talking about that legislation does.

Republicans filibustered a bipartisan proposal to create a bipartisan commission to investigate an attack on literally themselves. This says everything about the Republican party of today—the ends aren’t just anti-democratic, the means are too. That such a proposal—modest though it was—could meet such a fate also says a lot about the Democratic party of today too. In the run-up to the vote, West Virginia Democratic Sen. Joe Manchin expressed his growing frustrations with his Republican colleagues he viewed as placing partisanship over the health of the country (and his chamber), but he stressed that the solution was more patience. A minority of senators simply used the majority party’s rules against them. And that majority still doesn’t sound like it’s in any hurry to change them.

Emails tie top Trump exec Allen Weisselberg to yet another Trump scandal https://t.co/nMKJHssRci via @MotherJones

— gmrstudios (@gmrstudios) May 27, 2021

https://www.wonkette.com/tabs-thurs-may-27-2021

Eight people were killed and several others wounded in yet another mass shooting Wednesday. The latest sacrifice at the altar of the gun lobby occurred at a light-rail facility in San Jose, California. (CBS News)

Toxic masculinity is a common trait found among mass shooters in the United States. (Mother Jones)

Manhattan prosecutors pursuing a criminal case against Donald Trump’s corrupt enterprises has told at least one witness to prepare to chat with a grand jury. I want a Trump family perp walk. No, I deserve a Trump family perp walk. (CNN)

Ta-Nehisi Coates, Ava DuVernay, Angela Davis, Barry Jenkins, Ryan Coogler, and other individuals more impressive than Andrew Sullivan have signed a letter of support for New York Times journalist Nikole Hannah-Jones, who conservatives are treating like Galileo because she pointed out that slavery was a thing that happened in America. (The Root)

A chilling passage from this New York Times article about the Tulsa race massacre:

On May 31 and June 1, 1921, white mobs descended on the Greenwood district in Tulsa, Okla., shooting and pillaging their way through a vibrant and prosperous Black enclave, reducing it to rubble.

Low-flying airplanes dropped burning turpentine balls, leaving an entire block in what one eyewitness described as "a mass of flame." An all-white local contingent of the National Guard turned a machine gun on the Mount Zion Baptist Church, systematically raking the walls with heavy fire until the stalwart building gave way in a cascade of shattered glass and tumbling bricks.

The one up side, I suppose, to white America mostly forgetting the Tulsa race massacre ever happened is that repulsive people like Marjorie Taylor Greene won't compare the horrific event to someone having to wear a mask inside Trader Joe's. (The Daily Beast)

GOOD STUFF

Howard University is renaming its College of Fine Arts after the late (damn!) actor Chadwick Boseman, who graduated from the school in 2000 with a degree in directing. I still miss him. (Washington Post)

PANDEMIC

https://science.slashdot.org/story/21/06/05/0511217/floridas-government-may-have-ignored-and-withheld-data-about-covid-19-cases

Florida's Government May Have Ignored and Withheld Data About Covid-19 Cases (tampabay.com)

And they also report a position statement from the department (filed August 17th) acknowledging something even morning damning. While a team of epidemiologists at the Department of Health had developed data for the state's plan to re-open — their findings were never actually incorporated into that plan.

Reached for comment, a spokesperson for governor Ron DeSantis still insisted to the Herald that "every action taken by Governor DeSantis was data-driven and deliberate."

From the article:But when the Herald requested the data, data analysis, or data model related to reopening under Florida's open records law, the governor's office responded that there were no responsive records... Secrecy was a policy. Staffers were told not to put anything about the pandemic response into writing, according to four Department of Health employees who spoke on the condition of anonymity... Emails and texts reviewed by the Herald show the governor's office worked in coordination with Department of Health "executive leadership" to micromanage everything about the department's public response to the pandemic, from information requests from the press to specific wording and color choice on the Department of Health website and data dashboard. They slow-walked responses to questions on important data points and public records, initially withholding information and data on deaths and infections at nursing homes, state prisons and schools, forcing media organizations to file or threaten lawsuits. Important information that had previously been made public was redacted from medical examiner accounts of COVID-19 fatalities.

At one point the state mischaracterized the extent of Florida's testing backlog by over 50 percent — skewing the information about how many people were getting sick each day — by excluding data from private labs, a fact that was only disclosed in response to questions from the press. Emails show that amid questions about early community spread, data on Florida's earliest potential cases — which dated back to late December 2019 — were hidden from the public by changing "date range of data that was available on the dashboard."

Department of Health staffers interviewed by the Herald described a "hyper-politicized" communications department that often seemed to be trying to match the narrative coming from Washington.

The Herald's article also "delved into the details of the department's operation," writes DevNull127 :For example, the whistleblower complaint of Rebekah Jones quotes the state's deputy health secretary as telling her pointedly that "I once had a data person who said to me, 'you tell me what you want the numbers to be, and I'll make it happen.'"

Or, as Jones later described that interaction to her mother, "They want me to put misleading data up to support that dumb f***'s plan to reopen. And more people are gonna die because [of] this and that's not what I agreed to."

Last Friday the health department's Office of the Inspector General announced they'd found "reasonable cause" to open an investigation into decisions and actions by Department of Health leadership that could "represent an immediate injury to public health."

Meanwhile, Florida officials confirmed Friday night that their health department "will no longer update its Covid-19 dashboard and will suspend daily case and vaccine reports," according to the New York Times. "Officials will instead post weekly updates, becoming the first U.S. state to move to such an infrequent publishing schedule."

Jones had been using that data to continue running her own online dashboard, and posted Friday in lieu of data that the dashboard's operation would now be interrupted "as I work to reformat the website to adjust for these changes...." But she promised to keep trying to help the people of Florida "in whatever capacity I can with the limitations the Department of Health is now putting on public access to this vital health information."

Florida's Sun-Sentinel reports:Jones, a former Department of Health data manager fired for alleged insubordination, emerged as a political lightning rod as COVID-19 cases spiked in Florida last year. Supporters see her as a whistleblower speaking truth to power and exposing an effort by the state to paint a rosier picture of the pandemic. Her detractors say she has peddled disinformation for her own financial benefit, unfairly casting doubt on the reliability of Florida's COVID-19 statistics... Jones helped to build the state's online coronavirus dashboard in the early days of the pandemic. In May 2020, she was fired from her post at the Florida Department of Health, where she was manager of Geographic Information Systems. Jones said her bosses pressured her to manipulate statistics to justify reopening the state amid lockdown.

In an article Monday Forbes investigated "the curious case of Rebekah Jones' suspension," citing a researcher who specializes in Twitter fraud:There was clearly a concentrated surge in new follower activity... What is not known is whether Rebekah Jones purchased the followers herself, or whether it was a false-flag campaign meant to discredit her (someone else purchased the followers and directed them at her account to make it appear she broke Twitter's rules).

Nearly 21,000 followers were added in a short amount of time...

Following up with Twitter's spokesperson, Slashdot asked them about Forbes' theory, and whether they had evidence that Jones herself (and not one of her detractors) had perpetrated the surge in follower activity.

Twitter's response? "We have nothing further to add beyond what I shared."

Jones had already attained more than 400,000 followers, reports the Washington Post. But they also note that her suspension is now being celebrated on Twitter by Florida governor DeSantis's press secretary, "who was hired after she wrote an article calling Jones's claims 'a big lie.'"DeSantis's office also pointed to an April Twitter thread from a prominent disinformation researcher alleging that an app has surreptitiously directed thousands of users to follow a number of accounts, including Jones's. Jones responded to the researcher, according to a screenshot, with a tweet saying: "This is insane."

"I've never heard of this app," she wrote.

Jones has since opened a new account on Instagram named "insubordinatescientist".

PANDEMIC

THE WEEKLY PANDEMIC REPORT

If you prefer your data in a visual format, here's the current map from COVID Exit Strategy, using data from the CDC and the COVID Tracking Project.

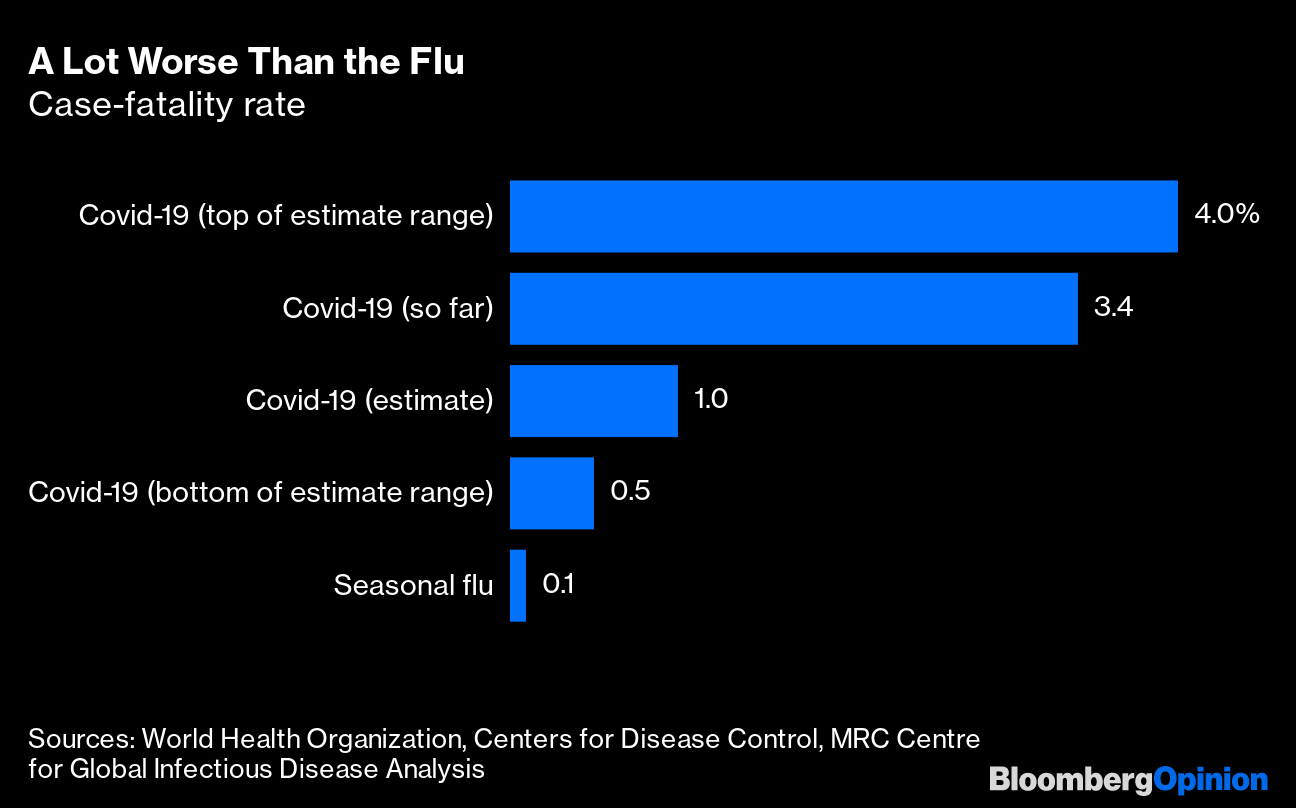

I want to add this link to the weekly report. It's important to remember:

A Sense of Doubt blog post #1983 - Is Coronavirus more contagious and more deadly than the flu? YES.

ALSO... I am seeing a big discrepancy between the Johns Hopkins data in death totals and WORLDOMETER data, which aggregates data from many more sources. Could this be the slow down due to the change in how the CDC obtains the data, having it filter first through Health and Human Services department.

United States

United States

Coronavirus Cases:

Deaths:

Recovered:

|

|

By the way WE AS THE PLAYERS wanna see who threw that popcorn on Russ while he was leaving the game tonight with a injury!! There’s cameras all over arenas so there’s no excuse! Cause if the 👟 was on the other 🦶🏾.🎥 #ProtectOurPlayers

— LeBron James (@KingJames) May 27, 2021

Man Dies Inside Spanish Dinosaur Statue After Trying To Retrieve His Phone (theguardian.com)

"A father and son noticed that there was something inside and raised the alarm," she said. "We found the body of a man inside the leg of this dinosaur statue. It's an accidental death; there was no violence. This person got inside the statue's leg and got trapped. It looks as though he was trying to retrieve a mobile phone, which he'd dropped. It looks like he entered the statue head first and couldn't get out." "We're still waiting for the autopsy results, so we don't know how long he was in there, but it seems he was there for a couple of days," she added.Slashdot reader shanen submitted this story with the following commentary:Not sure what the technology link is. Smartphones make people stupid? Dinosaurs are scientific, but this is ridiculous? It would be funny, but it's too gruesome. But I guess I'll go ahead and submit it in the Darwin Awards category. Maybe a better title is man kills himself with dinosaur and smartphone? Death by paper mache?

Enigmatic Designs Found in India May Be The Largest Images Ever Made by Human Hands (sciencealert.com)

Amidst this huge, dry landscape, the Oetheimers identified several sites located around the 'Golden City' of Jaisalmer, marked by geometrical lines resembling geoglyphs. Closer inspection during a field study in 2016 using an uncrewed aerial vehicle (UAV) revealed some of the identified sites were furrows dug for tree plantations, but also helped reveal a cluster of enigmatic line formations seemingly absent of trees. In particular, two "remarkable geometrical figures" of exceptional character close to the village of Boha stood out: a giant spiral and a serpent-shaped drawing, each connected by a cluster of sinuous lines.

The lines that make up these figures are stripes etched into the ground, ranging up to 10 centimeters deep (4 in) and spreading 20 to 50 cm wide (8-20 in). While these dimensions up close may be unremarkable, what they end up making up is not. The largest geoglyph identified, the giant asymmetrical spiral (called Boha 1), is made from a single looping line running for 12 kilometers (7.5 miles), over an area 724 meters long by 201 meters wide (790 by 220 yards). To the southwest of this huge vortex shape rests a serpentine geoglyph (Boha 2), composed of an 11-kilometer long line, which encompasses a serpent-like figure, a smaller spiral, and a long boustrophedon-style sequence of lines running back and forth. Other small geoglyphs can also be found in the Boha region (including a feature of meandering lines, called Boha 3), which in total includes around 48 kilometers of still visible lines today, which the researchers estimate may once have extended for about 80 kilometers.The researchers say it's unlikely these designs were intended as a form of artistic expression contemplated from the ground, but rather might have served as an unkown type of cultural practice in their making.

"Because of their uniqueness, we can speculate that they could represent a commemoration of an exceptional celestial event observed locally."

https://yro.slashdot.org/story/21/05/28/0045222/chinese-hackers-posing-as-the-un-human-rights-council-are-attacking-uyghurs

Chinese Hackers Posing As the UN Human Rights Council Are Attacking Uyghurs (technologyreview.com)

In addition to pretending to be from the United Nations, the hackers also built a fake and malicious website for a human rights organization called the "Turkic Culture and Heritage Foundation," according to the report. The group's fake website offers grants -- but in fact, anybody who attempts to apply for a grant is prompted to download a false "security scanner" that is in fact a back door into the target's computer, the researchers explained. "The attackers behind these cyber-attacks send malicious documents under the guise of the United Nations and fake human rights foundations to their targets, tricking them into installing a backdoor to the Microsoft Windows software running on their computers," the researchers wrote. This allows the attackers to collect basic information they seek from the victim's computer, as well as running more malware on the machine with the potential to do more damage. The researchers say they haven't yet seen all the capabilities of this malware.The researchers weren't able to determine an exact known hacking group, but the code in these attacks "was found to be identical to code found on multiple Chinese-language hacking forums and may have been copied directly from there," the report notes.

https://science.slashdot.org/story/21/05/27/222233/cities-have-their-own-distinct-microbial-fingerprints

Cities Have Their Own Distinct Microbial Fingerprints (sciencemag.org)

They found that about 45% didn't match any known species: Nearly 11,000 viruses and 1,302 bacteria were new to science. The researchers also found a set of 31 species present in 97% of the samples; these formed what they called a "core" urban microbiome. A further 1145 species were present in more than 70% of samples. Samples taken from surfaces that people touch -- like railings -- were more likely to have bacteria associated with human skin, compared with surfaces like windows. Other common species in the mix were bacteria often found in soil, water, air, and dust. But the researchers also found species that were less widespread. Those gave each city a unique microbiomeâ"and helped the researchers predict, with 88% accuracy, which city random samples came from, they report today in Cell.

The study's main value isn't in its findings (which are mapped here) so much as its open data, available at metagraph.ethz.ch, says Noah Fierer, a microbiologist at the University of Colorado, Boulder, who was not involved with the research. That will give other researchers the chance to delve into new questions. "Different cities have different microbial communities," Fierer says. "That's not super surprising. The question for me is, why?" Mason sees an opportunity for "awe and excitement about mass transit systems as a source of unexplored and phenomenal biodiversity." Newly discovered species have potential for drug research, he says, and wide-scale mapping and monitoring of urban microbiomes would be a boon for public health, helping researchers spot emerging pathogens early.

NASA's Mars Helicopter Goes On 'Stressful' Wild Flight After Malfunction (theguardian.com)

A built-in system to provide extra margin for stability "came to the rescue," he wrote in an online status update. The helicopter landed within five meters (16ft) of its intended touchdown site. Grip wrote: "Ingenuity muscled through the situation, and while the flight uncovered a timing vulnerability that will now have to be addressed, it also confirmed the robustness of the system in multiple ways. While we did not intentionally plan such a stressful flight, Nasa now has flight data probing the outer reaches of the helicopter's performance envelope."

https://news.slashdot.org/story/21/05/28/2155237/satellites-may-have-been-underestimating-the-planets-warming-for-decades

Satellites May Have Been Underestimating the Planet's Warming For Decades (livescience.com)

"It is currently difficult to determine which interpretation is more credible," Santer said. "But our analysis reveals that several observational datasets -- particularly those with the smallest values of ocean surface warming and tropospheric warming -- appear to be at odds with other, independently measured complementary variables." Complementary variables are those with a physical relationship to each other. In other words, the measurements that show the least warming might also be the least reliable.The findings have been published in the Journal of Climate.

The scientific case for exploring Venus has long been strong. No planet has more to say about how Earth came to be. Mars is tiny and frozen, its heat and atmosphere largely lost to space long ago. Venus could host active volcanoes, and it may have once featured oceans and continents, which are critical to the evolution of life. Plate tectonics roughly like Earth's might have held sway there, or might be starting today, hidden under the clouds. Venus also proves by example that orbiting within a star's "habitable zone" doesn't guarantee a planet is suitable for life. Understanding how Venus's atmosphere went bad and turned into a runaway greenhouse, boiling away any oceans and baking the surface, could help astronomers studying other solar systems distinguish truly Earth-like exoplanets from our evil twins.

Norton 360 Antivirus Now Lets You Mine Ethereum Cryptocurrency (bleepingcomputer.com)

As the difficulty of mining Ethereum by yourself is very high, Norton users will likely be pooled together for greater chances of mining a block. If Norton is operating a pool for this new feature, they may take a small fee of all mined Ethereum as is common among pool operators, making this new feature a revenue generator for the company."As the crypto economy continues to become a more important part of our customers' lives, we want to empower them to mine cryptocurrency with Norton, a brand they trust," said Vincent Pilette, CEO of NortonLifeLock. "Norton Crypto is yet another innovative example of how we are expanding our Cyber Safety platform to protect our customers' ever-evolving digital lives."

Thousands of microbes live inside the human body and work to keep us healthy. But scientists don't have a clear picture of how microgravity -- which allows the kind of floating weightlessness experienced by astronauts when they travel into space -- affects those microbes. That is the subject of an ongoing NASA research program called the Understanding of Microgravity on Animal-Microbe Interactions, or UMAMI. Scientists will study whether microgravity has an impact on the relationship between newly hatched bobtail squid, or Euprymna scolopes, and their symbiotic bacterium, Vibrio fischeri. The goal is to use what they learn about the relationship between squid and the microbes to help better prepare astronauts for lengthy space missions and preserve their health while they're out there.

In 2015, Dr. Sibert received a box of mud spanning about 40 million years of history. The reddish clay, extracted from two sediment cores that had been drilled deep into the Pacific Ocean seafloor, contained fish teeth, shark denticles and other marine microfossils. Using a microscope and a very fine paintbrush, Dr. Sibert picked through the two sediments and counted the number of fossils in samples separated in time by several hundred thousand years. About halfway through her data set, Dr. Sibert spotted an abrupt change in the fossil record. Nineteen million years ago, the ratio of shark denticles to fish teeth changed drastically: Samples older than that tended to contain roughly one denticle for every five fish teeth (a ratio of about 20 percent), but more recent samples had ratios closer to 1 percent. That meant that sharks suddenly became much less common, relative to fish, during an era known as the early Miocene, Dr. Sibert concluded. Dr. Sibert and her collaborators, in an earlier study using the same data set, had also found that sharks declined in abundance by roughly 90 percent about 19 million years ago. These declines in relative and absolute shark abundance suggest that something happened to shark populations about 19 million years ago, Dr. Sibert concluded.

But there was still the question of whether a true extinction occurred, she said. "We wanted to know if the sharks went extinct, or if they just became less prominent." To test the idea of an extinction, Dr. Sibert recruited Leah D. Rubin, a marine scientist then at the College of the Atlantic in Maine. Together, they developed a framework to identify distinct groups of denticles. The researchers settled on 19 denticle traits -- such as their shape and the orientation of their ridges. Dr. Sibert and Ms. Rubin sorted roughly 1,300 denticles into 88 groups. These groups don't correspond exactly to shark species, but seeing more groups is an indicator that a shark population is more diverse, the researchers proposed. Of the 88 denticle groups initially present before 19 million years ago, only nine persisted afterward. The reduction in shark diversity suggests that they experienced an extinction around that time, Dr. Sibert and Ms. Rubin concluded. In fact, this event was probably even more cataclysmic to sharks than the dinosaur-killing asteroid impact that occurred 66 million years ago, they said. "There were just a small fraction that survived into this post-extinction world," Dr. Sibert said.The researchers have no idea what caused this massive die-off. "There were no significant climatic changes in the early Miocene, and there's no evidence of an asteroid impact around that time," the report says.

Plans for Lynetteholm include a dam system around its perimeter, with the aim of protecting the harbour from rising sea levels and storm surges. If construction goes ahead as planned, the majority of the foundations for the island off Denmark's capital should be in place by 2035, with an aim to fully complete the project by 2070.Some of the environmental concerns include the transportation of materials by road, which will involve large numbers of vehicles to move the 80 million tons of soil required to create the peninsula alone. "There are also concerns among environmentalists about the movement of sediment at sea and the possible impact on ecosystems and water quality," the report adds.

Juno's science instruments will begin collecting data about three hours before the spacecraft's closest approach. Along with the Ultraviolet Spectrograph (UVS) and Jovian Infrared Auroral Mapper (JIRAM) instruments, Juno's Microwave Radiometer's (MWR) will peer into Ganymede's water-ice crust, obtaining data on its composition and temperature. Signals from Juno's X-band and Ka-band radio wavelengths will be used to perform a radio occultation experiment to probe the moon's tenuous ionosphere (the outer layer of an atmosphere where gases are excited by solar radiation to form ions, which have an electrical charge).

CNN explains why scientists are so excited:When the final Phase 3 data came out last November showing the mRNA vaccines made by Pfizer/BioNTech and Moderna were more than 90% effective, Dr. Anthony Fauci had no words. He texted smiley face emojis to a journalist seeking his reaction. This astonishing efficacy has held up in real-world studies in the U.S., Israel and elsewhere. The mRNA technology developed for its speed and flexibility as opposed to expectations it would provide strong protection against an infectious disease has pleased and astonished even those who already advocated for it...

This approach that led to remarkably safe and effective vaccines against a new virus is also showing promise against old enemies such as HIV, and infections that threaten babies and young children, such as respiratory syncytial virus and metapneumovirus. It's being tested as a treatment for cancers, including melanoma and brain tumors. It might offer a new way to treat autoimmune diseases. And it's also being checked out as a possible alternative to gene therapy for intractable conditions such as sickle cell disease.

In fact, Moderna is already working on personalized cancer vaccines, the article points out — and that's just the beginning. Two researchers whose technology underlies both the Modern and BioNTech/Pfizer vaccines are now also working on two vaccines against HIV, another one to prevent genital herpes, and two targeting influenza, including a so-called universal influenza vaccine that could protect against rapidly mutating flu strains, possibly offering years of protection with a single shot.

And researchers have also studied mRNA vaccines to fight Ebola, Zika, rabies and cytomegalovirus.

Earlier research by other groups had shown that the rotifers could survive up to 10 years when frozen. In a new study, the Russian researchers used radiocarbon dating to determine that the critters they recovered from the permafrost -- ground that is frozen year-round, apart from a thin layer near the surface -- were about 24,000 years old. The study was published in the journal Current Biology on Monday. It's not the first time ancient life has been resurrected from a permanently frozen habitat.

Overall enrollment in undergraduate and graduate programs has been trending downward since around 2012, and that was true again this spring, which saw a 3.5% decline -- seven times worse than the drop from spring 2019 to spring 2020. The National Student Clearinghouse attributed that decline entirely to undergraduates across all sectors, including for-profit colleges. Community colleges, which often enroll more low-income students and students of color, remained hardest hit by far, making up more than 65% of the total undergraduate enrollment losses this spring. On average, U.S. community colleges saw an enrollment drop of 9.5%, which translates to 476,000 fewer students. [...] Based on her conversations with students, [Heidi Aldes, dean of enrollment management at Minneapolis College, a community college in Minnesota] attributes the enrollment decline to a number of factors, including being online, the "pandemic paralysis" community members felt when COVID-19 first hit, and the financial situations families found themselves in.

The small trial recruited 28 participants in a crossover design, which is when all the volunteers go through each of the trial's conditions and their responses are compared to one another (as opposed to two or more distinct groups that either take the drug or placebo). The team found that these volunteers on average experienced a greater improvement in depression symptoms when they took the nitrous oxide at either dose than they did after taking the placebo (based on the primary survey they completed) -- an improvement that lasted for up to two weeks. Some doctors and patients had been using generic ketamine, taken through IV, as an experimental depression treatment for years. But Johnson & Johnson didn't fund expensive clinical trials to secure an approval for ketamine as a depression treatment; it instead developed a patentable form taken as a nasal spray, called esketamine. That sort of commercialization isn't something that's possible with nitrous oxide, according to Nagale.The study has been published in the journal Science Translational Medicine.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

- Bloggery committed by chris tower - 2106.05 - 10:10

- Days ago = 2171 days ago

- New note - On 1807.06, I ceased daily transmission of my Hey Mom feature after three years of daily conversations. I plan to continue Hey Mom posts at least twice per week but will continue to post the days since ("Days Ago") count on my blog each day. The blog entry numbering in the title has changed to reflect total Sense of Doubt posts since I began the blog on 0705.04, which include Hey Mom posts, Daily Bowie posts, and Sense of Doubt posts. Hey Mom posts will still be numbered sequentially. New Hey Mom posts will use the same format as all the other Hey Mom posts; all other posts will feature this format seen here.

No comments:

Post a Comment